Payroll is probably the most difficult element of running a small business. QuickBooks Online can make it easier.

Taking on a new worker is a daunting task in terms of your accounting responsibilities as a business owner. If the individual will be an employee, you’ll have tons of paperwork to do as you deal with the IRS state taxing agencies, benefits providers, and the new hires themselves.

Independent contractors, on the other hand, take far less work. But you must be sure the person you’re hiring is indeed a contractor that shouldn’t be classified as an employee. The IRS takes this distinction very seriously. Ask us if you’re at all unsure.

You can compensate independent contractors manually. But it can be a lot of work, and it’s prone to errors that can cost you in terms of penalties and unhappy workers who count on you for their livelihood. QuickBooks Online can speed up and simplify your payroll tasks and greatly decrease errors. Here are answers to some common questions.

Will it cost me more to pay independent contractors in QuickBooks Online?

If you’re only paying independent contractors, you can use QuickBooks Online’s built-in tools that allow you to issue paper checks to them. But you’ll need add-on capabilities if you, for example, want to pay by direct deposit or have QuickBooks e-file 1099-NECs for you. These require additional monthly fees.

How does QuickBooks Online track information about contractors?

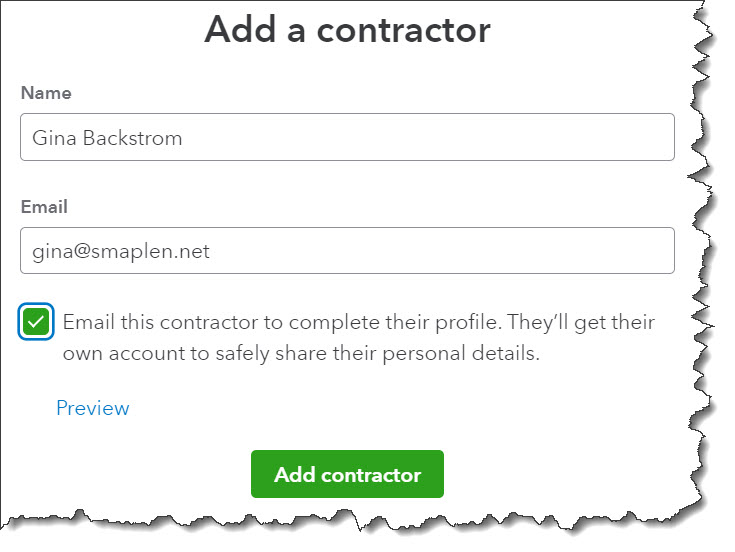

QuickBooks Online walks you through the process of creating individual records for contractors. Click Expenses in the toolbar and select Contractors. Click Add a contractor. A window opens containing fields for the contractor’s name and email address. Enter them, then check the box below it. QuickBooks Online will send an email to the individual, inviting him or her to set up an Intuit account (or sign into an existing one). Click Add contractor.

You can invite contractors to complete their personal profiles.

QuickBooks Online then walks the contractor step by step through the process of completing the personal profile, including contact information, business type, and Social Security number, which will be used to create a Form W-9, a document required by the IRS. When the contractor finishes it, she’ll be able to digitally sign it, and you’ll be notified that the task is done.

How Do You Pay Contractors?

Unless you subscribe to QuickBooks Contractor Payments and can set up direct deposit, your options for paying contractors will be limited. You can write a check, create an expense, or enter a bill from the Contractors “homepage.” Hover over Expenses in the toolbar again and click Contractors, then select your option from the dropdown list at the end of each row.

Or, from this same page, click Pay contractors. The page that opens displays a list of your contractors in a table. Select the bank account you’ll be using from the drop-down list in the upper left. Click the box in front of the name of each contractor you want to pay to open its details window. Since you haven’t set up direct deposit yet, your only option here is to create and print paper checks. Enter the Check number under Payment Method and complete the rest of the fields here.

Can I see how much I’m paying contractors?

Yes, you can. Click Reports in the toolbar and scroll down to What you owe. There are two reports here that you can customize and run, 1099 Contractor Balance Detail and 1099 Contractor Balance Summary. You can also run Contractor Payments (under Payroll) to see what payments you’ve made to contractors.

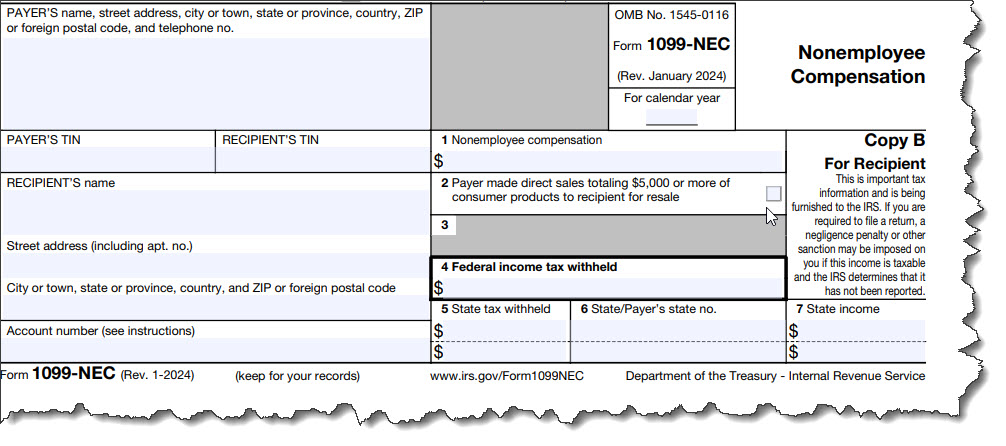

Can I create and file Form 1099-NECs for my independent contractors?

Not only can you, but you must submit Form 1099-NECs for independent contractors who you’ve paid $600 or more during the tax year. And if they’re not filled out correctly, you could face penalties from the IRS. Also, your contractors are counting on you to do this right because they must report their income to the IRS.

If you pay an independent contractor $600 or more in a tax year, you must send a Form 1099-NEC.

You’ll get the information you need from two places: the Form W-9 that the contractor supplied prior to being paid for the first time and the total compensation paid from your QuickBooks Online files. You can print your own 1099s and submit them through the U.S. Mail or pay QuickBooks Online to file them electronically.

A Complicated Chore

The mechanics of paying contractors aren’t difficult, but remember that you’re dealing with a task that must be done exactly right. We strongly urge you to let us assist as you set up and pay your first contractors. You don’t have to deal with the IRS and benefits providers like you do if you’re paying employees, but you want to be sure your payments are documented correctly so your 1099s are accurate.